What Are Technical Indicators? A Powerful & Smart Guide for Traders

A Practical and Powerful Guide for Smarter Trading Decisions

— By Bitcoinalyst

Technical indicators are some of the most widely used tools in trading, especially when we talk about technical analysis — yet also some of the most misunderstood.

Many traders overload their charts with indicators, while others avoid them completely.

In this guide, you’ll learn what technical indicators are, how professionals actually use them, when they help, and when they hurt your performance. This is a clear, practical explanation — not indicator hype.

What Are Technical Indicators?

Technical indicators are mathematical calculations applied to price, volume, or open interest. They are designed to help traders interpret market behavior, not predict it with certainty.

Indicators are derived from:

- Price

- Volume

- Time

In simple terms:

Technical indicators translate raw price data into visual signals that help traders make more informed decisions.

They do not replace price action or market structure — they complement them.

Figure 1: Ichimoku Cloud (trend + support/resistance) and ATR (volatility) shown together — combining directional bias with volatility context.

Major Categories of Technical Indicators

Technical indicators are tools that help traders interpret price action in a rule-based way. They are broadly categorised into trend, momentum, and volatility indicators — each offering different insights.

We’ve included the most common indicators across each category, including typical parameters and what they mean, so new traders can replicate them more confidently.

For a full walkthrough of how MACD and RSI work together in practice, consider taking a look at our: MACD + RSI Divergence post.

1. Trend Indicators

Help traders identify the direction and strength of a market move.

- Moving Averages (MA)

Smooth out price data over a set period to show overall direction.

Typical Parameters:

- 50-period SMA (slow trend)

- 200-period SMA (macro trend)

- 9 or 20 EMA (short-term trend)

What This Means:

The higher the number, the more historical price is averaged, making the MA slower and smoother.

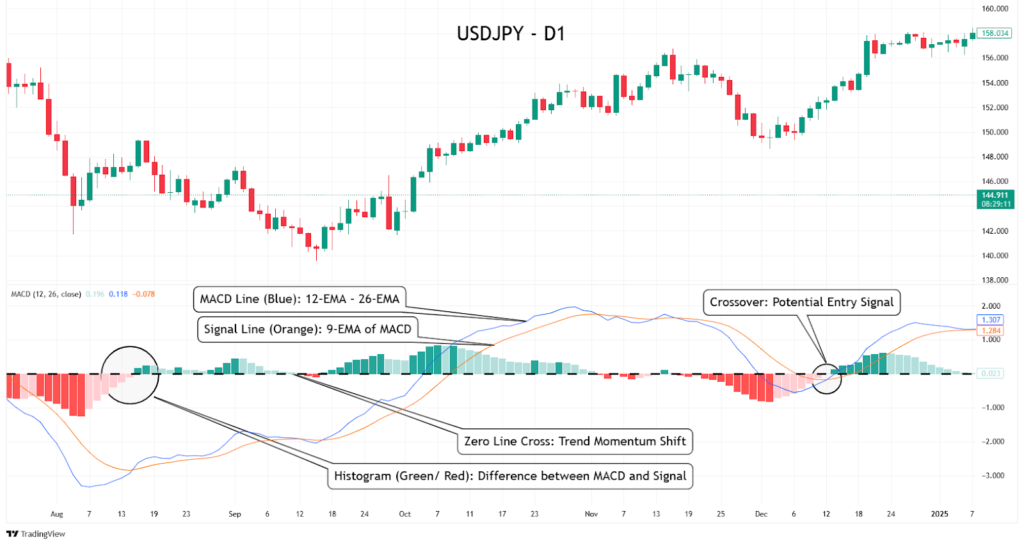

- MACD (Moving Average Convergence Divergence)

Highlights trend momentum and crossover signals.

Typical Parameters:

- 12 (fast EMA), 26 (slow EMA), 9 (signal line)

What This Means:

MACD line = 12 EMA – 26 EMA

Signal line = 9-period EMA of the MACD

Histogram = difference between MACD and signal line

Example: The MACD below shows the MACD line (blue), signal line (orange), and histogram. Annotated callouts explain how crossover signals and momentum shifts are interpreted.

Figure 1: MACD signals, histogram dynamics, and zero-line momentum shifts.

2. Momentum Indicators

Measure the speed of price movement — useful for spotting overbought or oversold conditions.

- Relative Strength Index (RSI)

Compares recent gains and losses to determine bullish or bearish pressure.

Typical Parameters:

- 14-period

What This Means:

RSI outputs a score from 0–100.

Above 70 = overbought. Below 30 = oversold. The 50 midline acts as trend confirmation.

- Stochastic Oscillator

Compares the current closing price to its recent high/low range.

Typical Parameters:

- %K = 14, %D = 3

What This Means:

%K is the main line, %D is the 3-period moving average of %K.

Overbought = above 80, Oversold = below 20.

Example: This RSI chart includes annotations for overbought and oversold zones, midline bias filtering, and potential reversal signals.

Figure 2: RSI chart identifying overbought/oversold zones and key momentum signal triggers.

3. Volatility Indicators

Show how much price is moving — not in direction, but in magnitude.

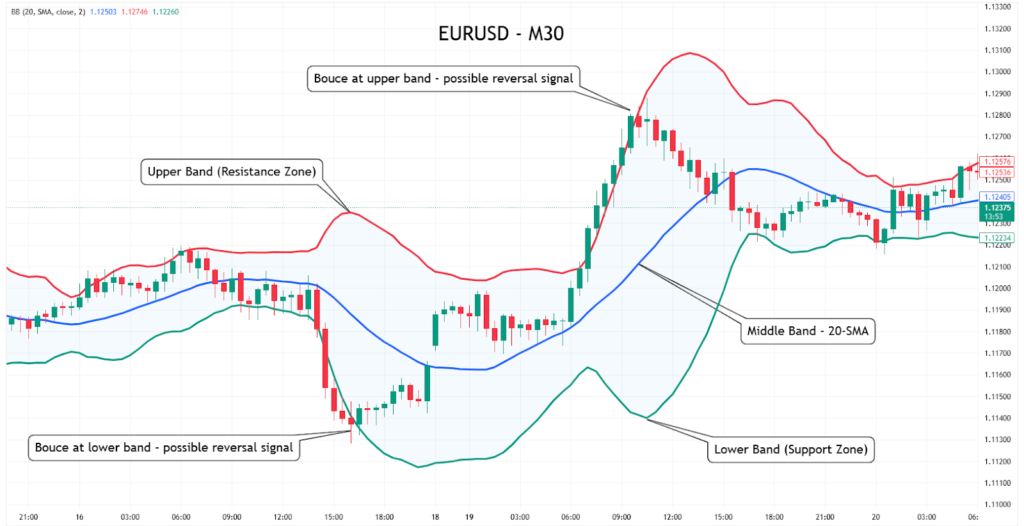

- Bollinger Bands

Defines a dynamic range around price using standard deviation.

Typical Parameters:

- 20-period SMA, 2 standard deviations

What This Means:

The bands expand and contract with volatility. Price touching outer bands may signal extremes.

- ATR (Average True Range)

Measures average volatility over a given period.

Typical Parameters:

- 14-period

What This Means:

The higher the ATR, the more volatile the market. It’s not directional — only magnitude.

Example: The Bollinger Bands chart below highlights potential reversal points at the upper and lower bands, as well as the role of the midline (SMA).

Figure 3: Bollinger Bands example showing volatility boundaries and bounce-based reversal setups.

Key Uses of Technical Indicators

When used correctly, technical indicators add structure and confirmation to a trading plan.

Confirmation, Not Prediction

Professional traders use indicators to:

- Confirm price action setups

- Validate trend direction

- Filter low-quality trades

Indicators work best after price has already shown intent.

Trade Management

Indicators are excellent for:

- Managing exits

- Adjusting stop losses

- Measuring volatility

For example, ATR-based stops adapt to market conditions instead of using fixed pip values.

Consistency and Discipline

In prop trading and funded accounts, indicators help:

- Reduce emotional decision-making

- Follow repeatable rules

- Maintain consistency

This is why many prop firms allow indicators but discourage indicator-only systems.

When Not to Rely on Indicators

Indicators become dangerous when traders:

- Use too many at once

- Ignore price structure

- Chase signals without context

Indicators Lag

Most indicators are lagging — they react to price, not lead it. This means:

- Signals appear after moves begin

- Late entries increase risk

Ranging and News Conditions

Indicators perform poorly when:

- Markets are ranging with low volatility

- High-impact news causes sharp spikes

In these conditions, price action and support/resistance outperform indicators.

Indicator Dependency

If you cannot explain why a trade works without an indicator, the indicator is controlling you — not helping you.

Summary Points (Key Takeaways)

- Technical indicators are tools, not strategies

- They are best used as confirmation

- Different indicators serve different purposes

- Overuse reduces clarity and performance

- Price action always comes first

The best traders use few indicators, with clear purpose.

Final Thoughts from Bitcoinalyst

Indicators are not shortcuts.

They are decision aids.

When combined with price action and market structure, technical indicators can improve clarity and discipline. When used alone, they often create confusion.

Master price first.

Use indicators second.

Trade with intention.