Liquidity Tsunami Incoming: Is 2025 the Year Crypto Goes Parabolic?

Global Money Printers Go Brrr: How Surging Liquidity Signals a Crypto Boom in 2025

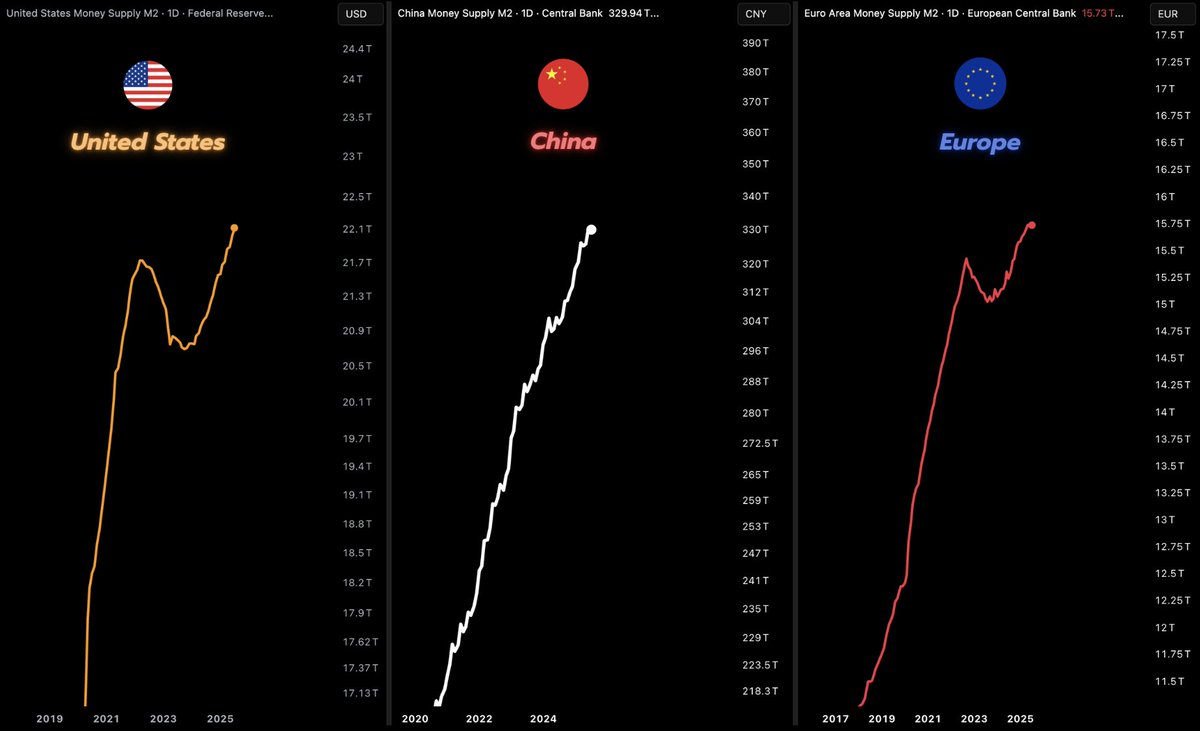

As of September 2025, the world’s major economies are firing up their money printers once again, with M2 money supply metrics in the United States, China, and Europe all pushing toward or surpassing all-time highs.

This surge in global liquidity—fueled by central bank policies aimed at staving off economic slowdowns—has profound implications for risk assets in crypto, particularly Bitcoin (BTC) and the broader cryptocurrency market.

With total global M2 now exceeding $105 trillion, up from a low of $94 trillion in late 2022, investors are eyeing this as a classic tailwind for crypto. But why does “easy money” matter so much for digital assets?

Let’s break it down, drawing on the latest data and historical patterns that suggest a bullish horizon for BTC and beyond.

America’s Liquidity Lifeline: US M2 Hits Record Territory

The United States, the world’s largest economy, leads the charge with its M2 money supply reaching a staggering 22.12 trillion USD as of July 2025, marking a new all-time high and reflecting a 4.53% year-over-year growth rate—the strongest since mid-2024.

This expansion comes on the heels of the Federal Reserve’s pivot from quantitative tightening to a more accommodative stance, including hints of further rate cuts amid cooling inflation (now at 2.6% PCE).

After contracting briefly in 2023 due to aggressive rate hikes, M2 has rebounded sharply, adding over $1 trillion since early 2025. Historically, such liquidity injections have devalued the USD, prompting investors to seek alternatives like Bitcoin as an inflation hedge.

With the Fed’s balance sheet still bloated at $7.2 trillion and potential stimulus from fiscal policies under the new administration, US M2 growth is poised to accelerate, injecting fresh capital into high-growth assets.

China’s Credit Machine Revs Up: M2 Surges Amid Economic Stimulus

Across the Pacific, China’s M2 money supply has ballooned to approximately 330 trillion CNY (around 46 trillion USD at current exchange rates) by mid-2025, up 8.3% year-over-year and continuing a multi-year upward trajectory that has seen it more than double since 2019.

The People’s Bank of China (PBOC) has ramped up stimulus measures, including reserve requirement ratio cuts and targeted lending to support infrastructure and tech sectors, pushing M2 to new peaks despite global trade tensions.

This growth, the fastest since 2021, reflects Beijing’s efforts to counter domestic slowdowns and boost exports.

For crypto, China’s liquidity flood is a double-edged sword: while domestic trading remains restricted, outbound capital flows and Hong Kong’s crypto hub status are channeling funds into BTC and altcoins.

As the world’s second-largest economy prints money at this pace, it dilutes the yuan and drives global investors toward scarce assets like Bitcoin, which has historically captured about 10% of new liquidity in similar cycles.

Europe’s Steady Pump: ECB’s M2 Climbs to Fresh Highs

In the Eurozone, M2 money supply has climbed to 15.73 trillion EUR (roughly 17.2 trillion USD) as of June 2025, with a 3.3% YoY increase signaling a breakout from post-pandemic stagnation.

The European Central Bank (ECB) has eased rates to 3.5% and expanded its asset purchase programs amid sluggish growth and energy price volatility, adding over 500 billion EUR to M2 since early 2025.

This marks the highest levels since 2022, reversing a brief contraction and aligning with broader EU fiscal stimulus.

Europe’s liquidity surge is particularly bullish for crypto, as it coincides with regulatory clarity—such as the MiCA framework—encouraging institutional adoption.

With inflation easing to 2.2%, the ECB’s dovish pivot is flooding markets with cheap money, historically boosting risk-on sentiment and BTC prices by up to 150% in prior expansion phases.

Why This Liquidity Tsunami is Rocket Fuel for Bitcoin and Crypto

The synchronized M2 explosions across these powerhouses aren’t just numbers on a chart—they’re a green light for Bitcoin and cryptocurrencies.

Global liquidity has a proven 0.94 correlation with BTC prices over the long term, with bull markets often lagging expansions by 60 days.

As fiat currencies dilute, investors flock to Bitcoin’s fixed supply of 21 million coins, viewing it as “digital gold.” Analysts like those at Real Vision predict BTC could capture 10% of the projected $20 trillion in new global money supply by end-2025, potentially pushing prices to $150,000–$200,000.

This isn’t isolated: Ethereum and Solana benefit too, with DeFi TVL surging 20% in Q3 2025 amid cheap capital.

Historical precedents, like the 2020–2021 stimulus wave that sent BTC from $10K to $69K, underscore this dynamic.

Even with risks like regulatory hurdles or recessions, the current environment—marked by Fed/ECB/PBoC easing—positions crypto for explosive growth.

In a world of endless money printing, Bitcoin and crypto aren’t just surviving—they’re thriving as hedges against fiat erosion.

With global M2 eyeing $118 trillion by 2026, 2025 could be the year digital assets cement their role in portfolios. Investors: Watch liquidity metrics closely; the next leg up might already be in motion.

Join my community of crypto Elite Traders!

🚀 Recommended Exchange (Bitunix review)

🚀 Trade on Bitunix for big rewards and prizes